6 Ways to Prepare to Buy a House

So you’ve decided to buy your first home, or you’re already a homeowner and are ready to move into a new place. But, there’s more to a home purchase than picking your favorite listing and just moving in.

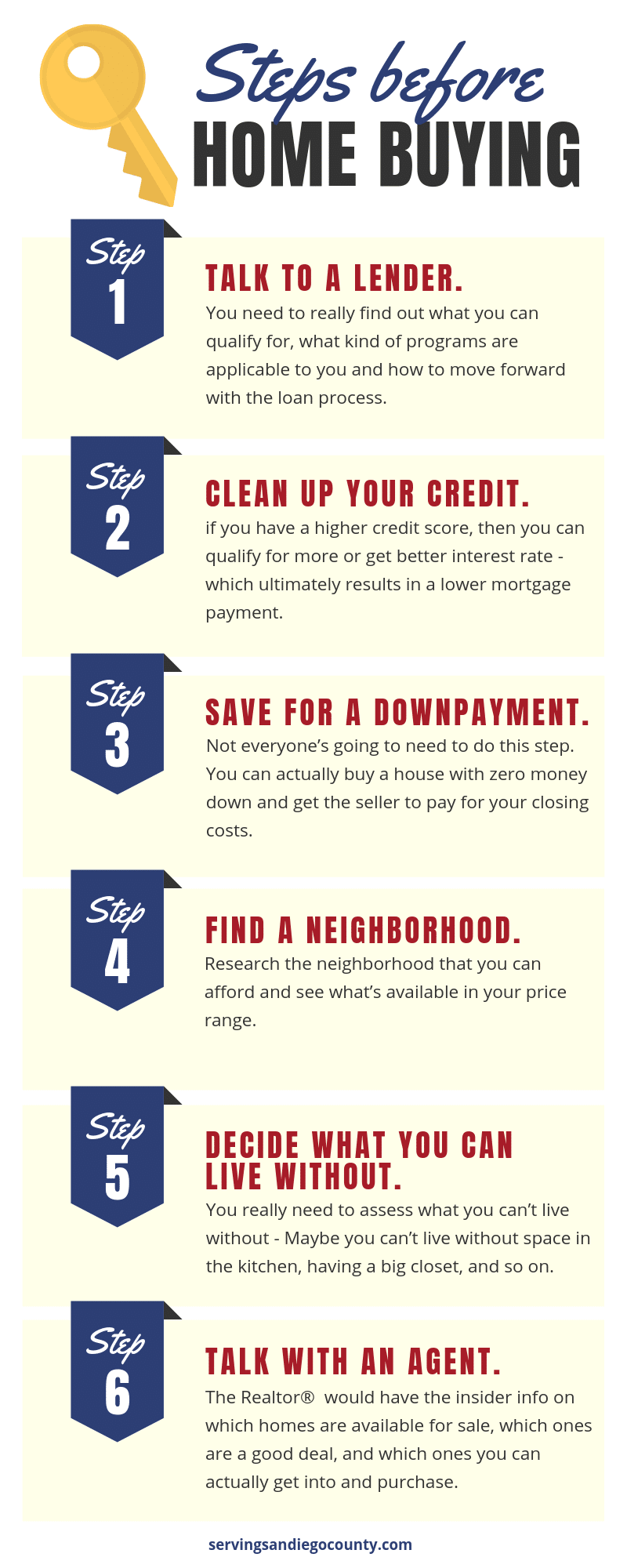

Here are the six things that you need to do to prepare to buy a home.

Home Buyer’s To-Do List…

Step 1: Talk to a Lender

There are all sorts of loan programs and all sorts of different mortgage lenders out there. And you need to really find out what you can qualify for, what kind of programs are applicable to your situation, and how to move forward with the loan process.

Step 2: Clean Up Your Credit

Not everybody’s going to have to do this step. But that’s why you have to talk to the lender first because sometimes if you have a higher credit score, then you can qualify for more or get better interest rate—which ultimately results in a lower mortgage payment. It’s a good idea to take some time—if you need to—to clean up your credit and raise your score. It could be a short period of time, but it will give you the possibility of buying more.

Step 3: Save for a Down Payment

Believe it or not, not everyone’s going to need to do this step; not everyone is going to need to bring the down payment to the table. You can actually buy a house with zero money down and get the seller to pay for your closing costs: the cost of escrow, title etc. However, for some people, you may need to save up some money. The good news is that now you can buy a home with 3.5% down, 5%, even 0% down!

So when you speak with the lender, then you can figure out: do I need to save money? How much? And you can make a plan for doing that. If you’re having trouble saving money, we highly recommend you read The Total Money Makeover by Dave Ramsey.

Step 4: Find a Neighborhood

Your budget and the conversation with the lender is going to dictate how much you can spend. If you’re in San Diego County, going coastal can often be more expensive. So once you know how much you qualify for, if you really want to go coastal, and you are on a tight budget, your options may be more limited. You may not be able to get a six-bedroom house on the coast, but you may be able to get a bigger home inland, depending upon your neighborhood. So you really need to research the neighborhoods that you can afford and see what’s available in your price range.

Step 5: Decide What You Can Live Without

People who are out viewing homes, shopping for homes, looking at homes, often need to consider a few things: they might see a spot on the carpet or get a weird smell because maybe there was an animal that lived in the property before. But that’s okay – those things can be corrected. You really need to assess what you can’t live without. Maybe you can’t live without space in the kitchen or you like having your own bathroom sink in the master, having a little bit of privacy, having a big closet and so on. Certain things definitely cannot be fixed affordably, and things like a new carpet or a new flooring can be changed more affordably.

Step 6: Talk with an Agent

This step doesn’t have to be last, but it is very, very important. You can talk with an agent and even get a referral to some good mortgage lenders. But agents can crack the code to properties on the internet. You might go on Zillow or you might go online and search for properties. Many of them may look awesome, but you might find out that there is some structural problem and that’s why they’ve been on the market or that’s why they’ve been at this great price. The real estate agent would have the insider info on which homes are available for sale, which ones are a good deal, and which ones you can actually get into and purchase. Speaking with a good agent (such as the agents at Broadpoint Properties) is one of the most vital parts of that process!

Take the time to educate yourself about what you are getting into before you take the plunge into buying any property. When you are ready, please give us a call!