As a homeowner, you are expected to pay property taxes. And sometimes, especially if you’re a new homeowner, these taxes and charges can cause overwhelm and confusion. We’re here to help you gain clarity regarding real estate taxes in the state of California.

Established by California’s Proposition 13 passed in 1978, the base tax amount is calculated by multiplying the property’s assessed value by the standard tax rate of 1%. The property’s assessed value is factored based on the last time that your home was sold or the sales price listed on the deed.

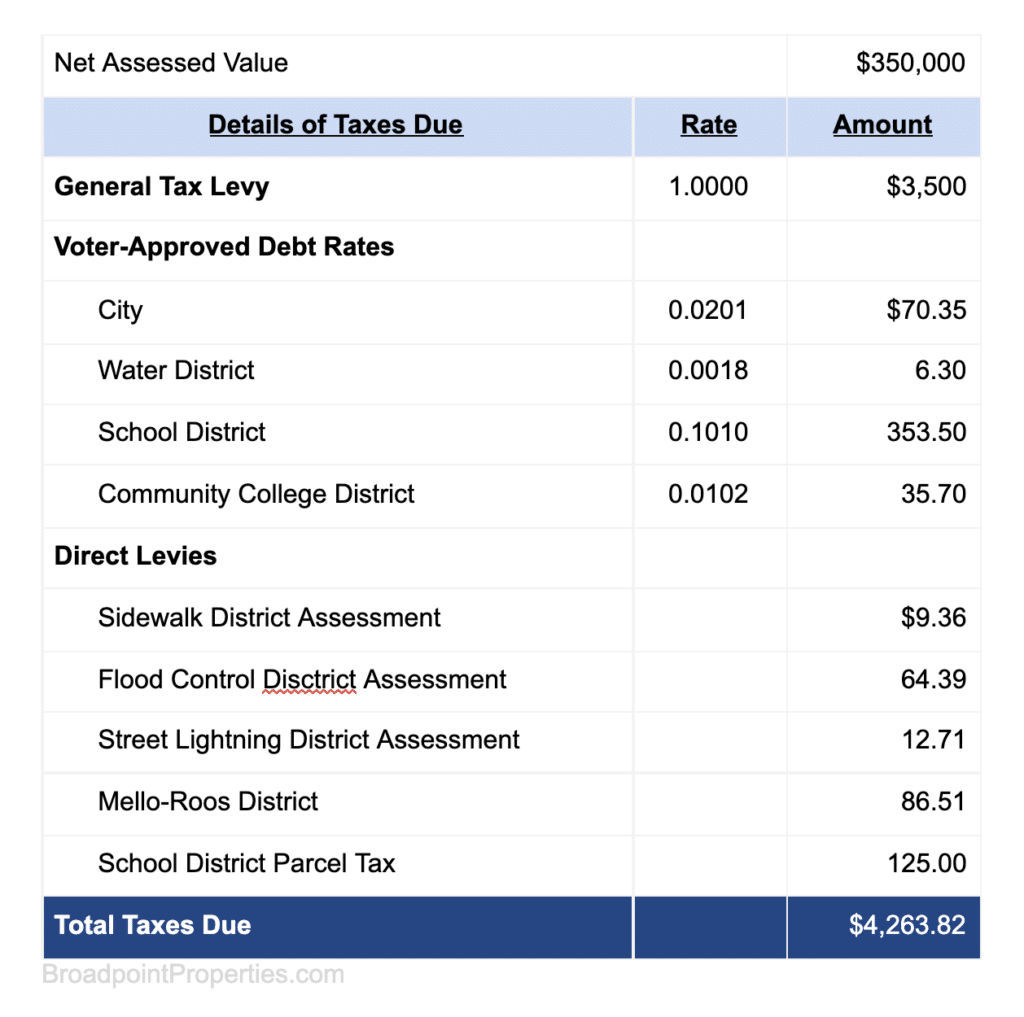

To illustrate, say your home is valued at $350,000 the last time it was sold, get 1% of that and that’s the amount you pay annually – that’s $3500/yr or $291/mo.

Over time, the property’s assessed value is adjusted upward as properties appreciate. In San Diego County, for instance, the average annual appreciation is 0.73%. Also, if you’ve made renovations on your home, the assessor may factor this into the new property value. This is good news if you’ve been living in the same home for a long time, as the assessed value is usually lower than the market value, especially in the state of California, where home values can increase rapidly year after year.

Additional taxes such as voter–approved debt rates, parcel taxes, Mello–Roos taxes, and assessments may be included in your total tax due. Homeowners in California are also eligible for a $7,000 reduction to the assessed value on their primary residence. You can only claim this exemption once, and it’s commonly done shortly after you buy.

Below is an example of an Annual Property Tax Computation

Hope this covers all the bases of what you need to know about real estate taxes in California. It is always a good idea to consult with both a real estate professional and a tax professional for further help. When in doubt, please feel free to contact the agents at Broadpoint Properties.

Source: Legislative Analyst’s Office