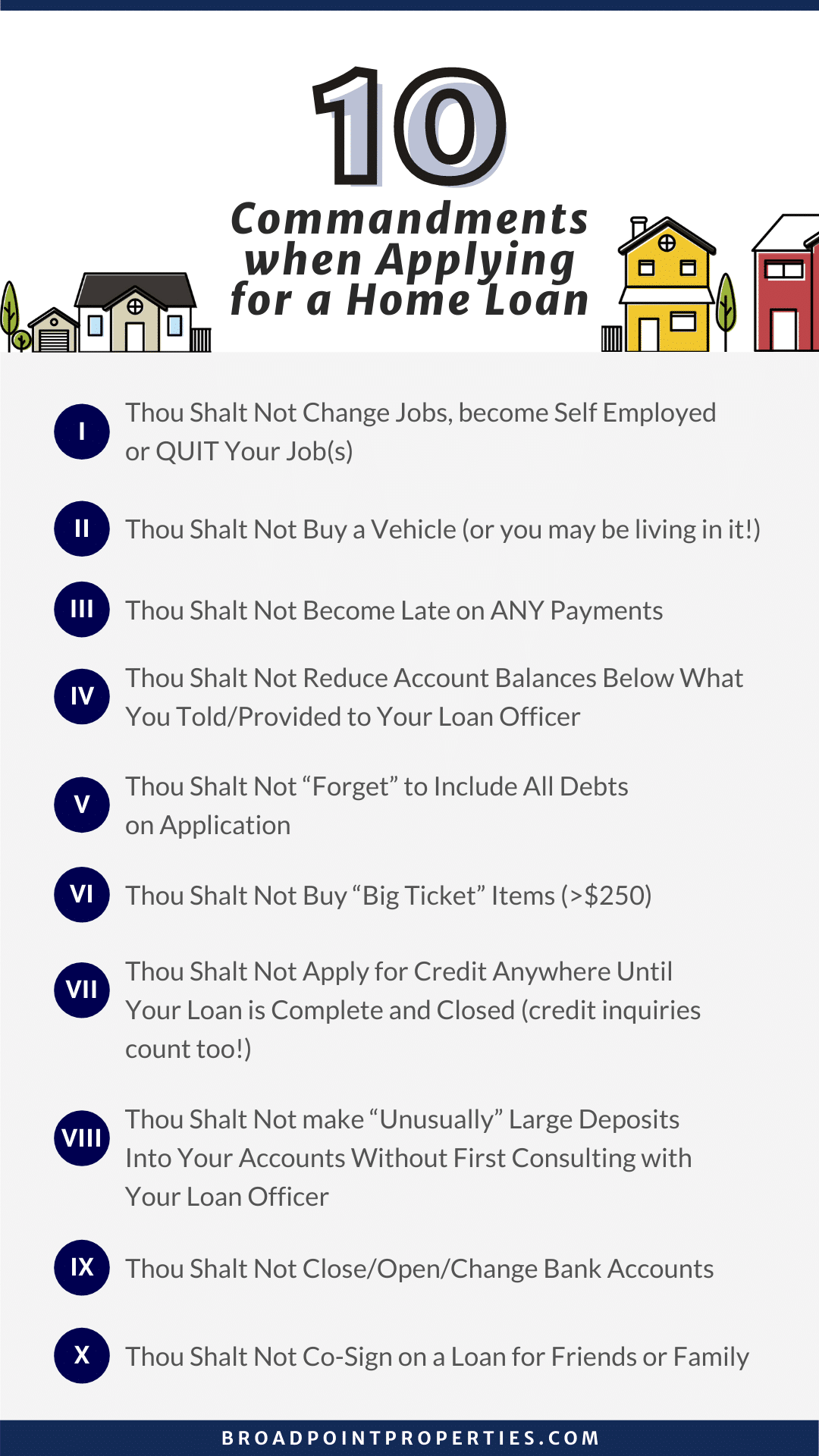

With recent low rates on mortgage (at 2.72% for a 30-year loan as of this writing), it’s totally understandable that you and others are compelled to make a home purchase now. But before you do that, we want to help you set it straight and avoid the following financial no-nos when applying for a home loan. Here are what we’d like to call the 10 Commandments of Getting a Home Loan (or what not to do when the loan is in process).

The 10 Commandments of Getting a Home Loan

I. Thou Shalt Not Change Jobs, become Self Employed or QUIT Your Job(s)

II. Thou Shalt Not Buy a Vehicle (or you may be living in it!)

III. Thou Shalt Not Become Late on ANY Payments

IV. Thou Shalt Not Reduce Account Balances Below What You Told/Provided to Your Loan Officer

V. Thou Shalt Not “Forget” to Include All Debts on Application

VI. Thou Shalt Not Buy “Big Ticket” Items (>$250)

VII. Thou Shalt Not Apply for Credit Anywhere Until Your Loan is Complete and Closed (credit inquiries count too!)

VIII. Thou Shalt Not make “Unusually” Large Deposits Into Your Accounts Without First Consulting with Your Loan Officer

IX. Thou Shalt Not Close/Open/Change Bank Accounts

X. Thou Shalt Not Co-Sign on a Loan for Friends or Family

Ultimately, you want your financial records and decisions to lead you to the path of mortgage success so make sure to keep the above-mentioned factors in mind for a worry-free home purchase experience. If you or anyone you know is interested in being qualified to purchase a home at today’s low rates, feel free to contact the agents at Broadpoint Properties.