Homeowners insurance, or sometimes called a home insurance, is a type of insurance policy that provides financial protection for your home and its contents in the event of damage, loss, or liability. It is important because it provides coverage for the repair of personal belongings or rebuilding of your home if they are damaged or destroyed. It can offer a homeowner peace of mind in case of unexpected events.

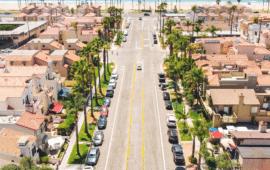

In San Diego, events such as wildfires, earthquakes, floods, and landslides have the potential to occur, and each of them necessitates additional insurance coverage to ensure adequate protection. Home insurance typically costs around $974 per year, or $81 per month, for a policy with $250,000 in dwelling coverage*. While it is not legally required, it’s better to be safe than sorry… so homeowners are highly encouraged to get a policy. Note that if you have a mortgage, your lender will require that you have a policy.

Several factors may impact a homeowners insurance, including the following:

Location

The location of your home can impact your insurance rates. Homes in areas prone to natural disasters like floods, hurricanes, or earthquakes may have higher rates.

Home Age and Condition

Older homes may be more expensive to insure due to their age and condition. Homes with outdated electrical or plumbing systems, or those in need of major repairs may also have higher rates.

Replacement Cost

The replacement cost of your home is the amount it would cost to rebuild your home if it were destroyed. The higher the replacement cost, the higher your insurance rates may be.

Home Features

Certain home features, like swimming pools or trampolines, may increase your liability risk and therefore, increase your insurance rates. Additional costs may also apply for home-based businesses.

If you have a pet, certain breeds of dogs may also factor in the increase your insurance premium due to the increased risk of dog bites or other incidents.

Claims History

If you have a history of filing insurance claims, your premiums may be higher due to the increased risk.

Insurance Coverage Limits

The amount of insurance coverage you choose can impact your rates. Higher coverage limits may result in higher premiums.

Consider these factors when shopping for homeowners insurance and to compare rates and coverage from multiple providers to find the best option for you. Reach out to us so we can refer you to a trusted home insurance company.