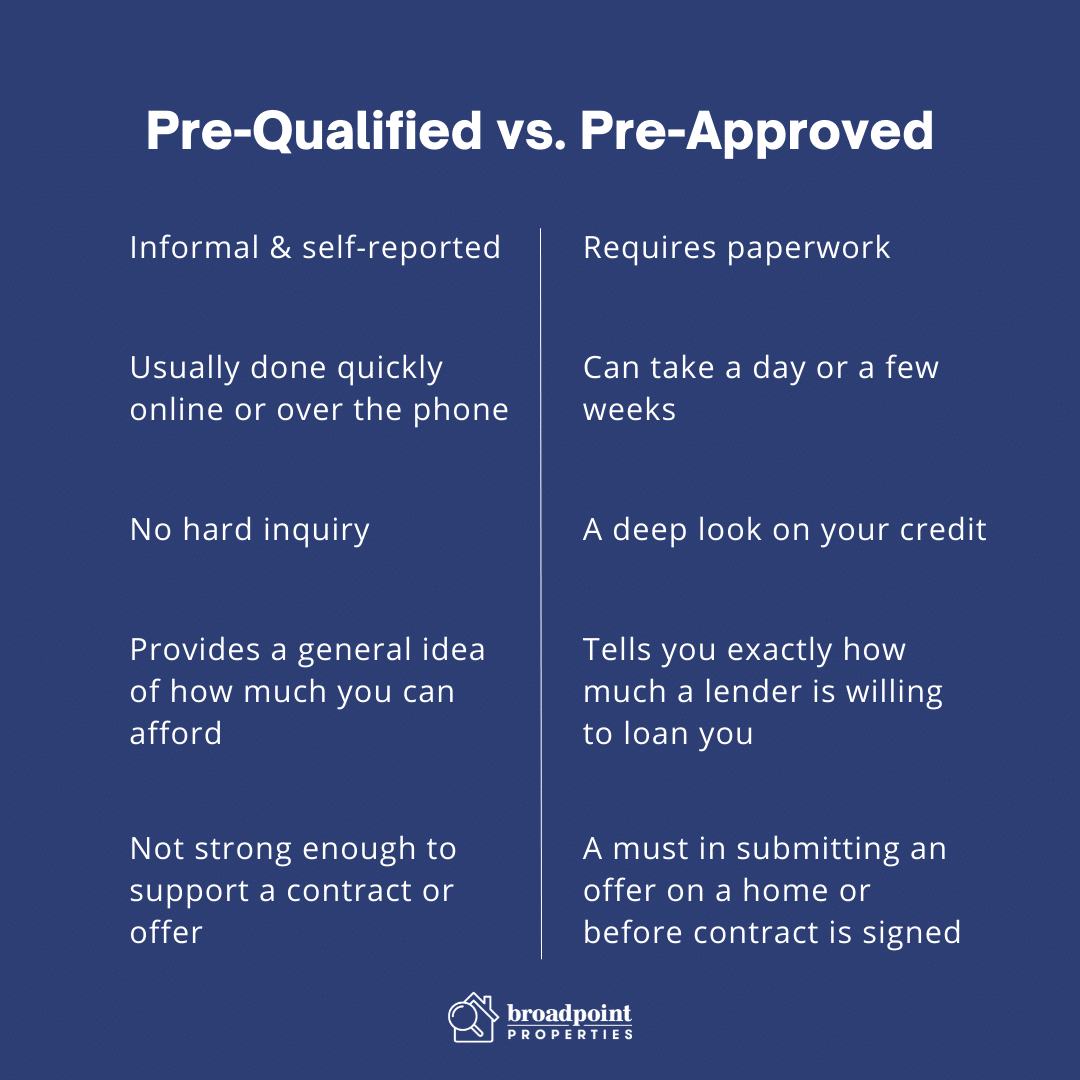

Both pre-qualification and pre-approval are smart moves when buying a home. Yet there is some confusion between the two real estate terms. Knowing the difference between the two can save you from potentially losing the home of your dreams. Here are some main differences between pre-qualifying and pre-approval.

Homebuyer Hacks: Difference Between Pre-Qualified vs Pre-Approved

What is mortgage pre-qualification?

It is a general estimate of the loan amount you can afford. This is where the lender takes a look at the financial data you provide and finds out how much of a loan you might qualify for, which can be especially helpful for first-time home buyers. This is where you also get the opportunity to learn about different mortgage options. The process can be done online or over the phone.

Pre-qualification is not strong enough proof to support a contract or offer, which makes realtors and home sellers think that you’re only looking around for a home for now.

What information is provided?

- Your income information

- Basic information about your bank accounts

- The down payment amount and desired mortgage amount

What is mortgage pre-approval?

This is where your financial and employment history is thoroughly reviewed by the lender. They will then decide and approve you for a specific loan amount.

Having a pre-approval will mean for the home seller and realtor that you are a serious buyer, which will then make you more favorable in a competitive market vs other potential buyers. This is also a requirement before a contract is signed or an offer on a home is submitted.

What information is provided?

- Proof that shows your most recent income for the past 30 days

- Credit check

- Bank account numbers or two most recent bank statements

- The down payment amount and desired mortgage amount

- W-2 statements and signed, personal and business tax returns from the past two years

There’s more to a home purchase than picking your favorite listing and just moving in. But don’t be discouraged; we are here to help to get you prepared. Here are other essential steps when it comes to home purchase.