Buy Now: Interest Rates Are Still Low

As mortgage interest rates increase, the cost of borrowing increases. Interest rates (including mortgage interest) are dictated by several factors—specifically, how the economy and market are performing. So when the recession hits or the economy is under performing, the Feds lower the interest rate.

When you get a loan, the mortgage interest rate is affected by the economy, how the market is performing in your area (buyers market or seller’s market) and even your credit standing (credit score). The better your credit, the lower your interest rate may be.

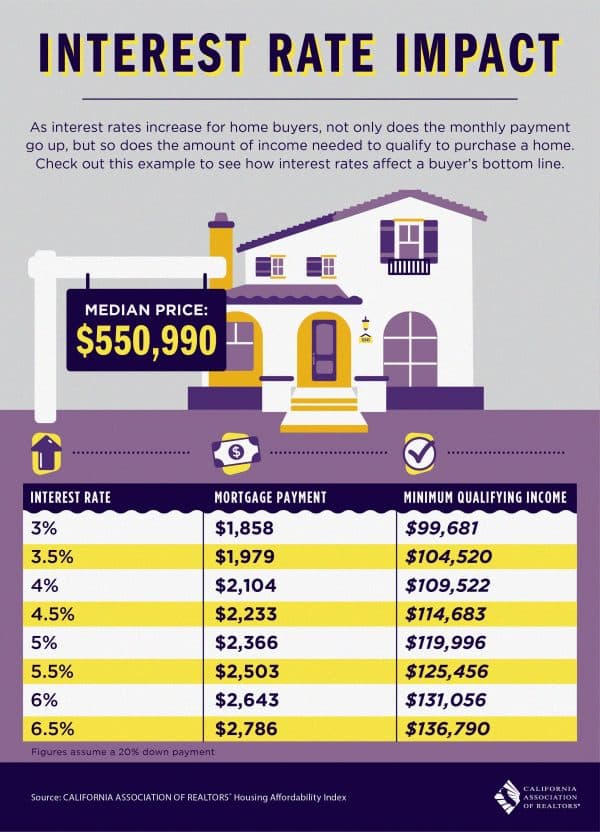

Below is a sample how the interest rates affect buyers monthly payment and amount of income needed to qualify for the purchase.

By the time you are ready to buy your first home, the interest rate will spike up. It’s better to buy your home now when the interest rate is relatively lower. As the market gets better, the interest rate will be higher.

If you or anyone you know needs further advice about a future home sale, please contact the agents at Broadpoint Properties.

Source: California Association of Realtors *Housing Affordability Index