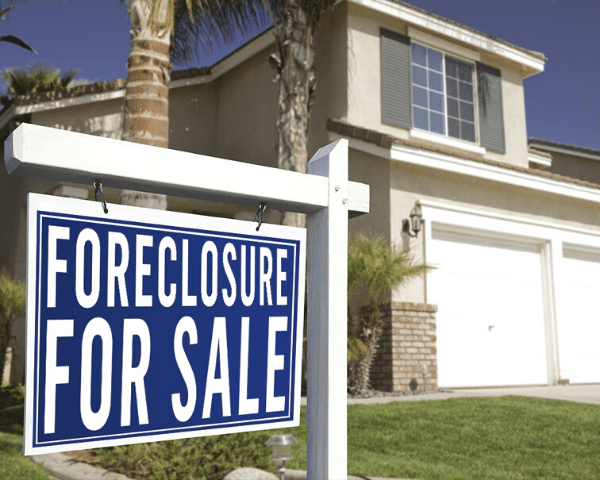

Purchasing a home that has been foreclosed upon can be very appealing when you’re looking for a home for you to live in for a cheaper price, a real estate investment to flip and sell, or a chance to live in a neighborhood you otherwise can’t afford. As for the process of buying a foreclosed home, it is not too different from when you’re buying a regular home. The main difference between buying a foreclosure and a traditional property is that with a foreclosure, the seller is the bank.

If you’re thinking about buying a foreclosure, here’s what you need to do:

- Set a budget

Evaluate your current financial situation and see how much per month can you allocate for the mortgage. Be really honest with your assessment, as sometimes, because you think that you’re getting a good bargain, that you might overstretch your budget.

Factor into your budget cost for repairs as well. Also, the market moves faster than with a traditional sale, so you need to be ready to make a sound offer and be financially secured.

- Know where to look

As with a traditional sale, the research step is very important. You can buy foreclosed properties from the following:

– Online

– At an auction

– From the bank

– From a government entity (such as HUD or even Fannie Mae)

- Hire an Experienced Real Estate Agent

And this step is a must! The process can be slower as there is more paperwork to be settled. When purchasing a foreclosure, banks often set the rules by insisting upon certain contracts and conditions, and often, the contracts are 20-plus pages long and designed to protect the bank, with no benefit to the buyer. So, the best way for you to protect yourself is by having your own agent, who acts as a fiduciary in the buyer’s best interest.

- Get Preapproved For A Mortgage

No matter what type of home you buy, especially In a highly-competitive housing market, it’s akin to self-sabotage to not get pre-approved before making an offer. What lenders do is verify your income and credit score. This will then determine how much mortgage you can qualify for.

- Get A Home Inspection

Most of the time, you’ll buy the property as is. You might end up doing lots of repairs which could cause you a lot of stress after the sale. Hire an inspector for an extra set of eyes to help you point out the issues you may have missed.

In general, reports will tell you about the condition of the following areas:

- Heating and cooling equipment

- Plumbing and electrical wiring

- Roof and attic

- Structural elements

- Walls

- Insulation

Before making an offer, keep a keen eye on some signs of a money pit property.

- Make a Competitive Offer

You’ve done all the research and preparation, you’re feeling confident about this buy and like it, put a ring on it – besides, making an offer is free. If you saw a foreclosed property that looked like a good deal, make an offer on it before it’s off the market.

Hope these tips will save you headaches in your home purchase. If you’re ready to take the next step and buy a home in North San Diego County, contact us and we’ll find you the perfect home.